NEW! Green Mortgage Makeover

Irish banks are required to demonstrate sustainable lending to the European Central Bank, and one of the ways they do this is by offering Green Mortgages, which can be up to 1.0% cheaper than variable or standard fixed rates. Green Mortgages are here for the foreseeable future. Different lenders have different offers, with the most lenders offering disounted Green Mortgages for houses that have a BER rating of A or B.

How can I check my BER rating?

BER ratings are valid for 10 years, and you can check the status of your property by entering the MPRN from your electricity bill here.

How can you avail of a discounted Green Mortgate if your house currently does not have a BER rating of A or B?

If your house was built from 1990 onwards, it likely has a BER Rating of C or D rating depending on a range of factors.

The Green Mortgage Makeover is a premium, white-glove service designed to guide you through the most cost-effective path to a B-rated home (and beyond if you wish)—and unlock the benefits of a Green Mortgage.

The service goes well beyond just providing a BER (Building Energy Rating). This expert-led process evaluates your home's current energy performance, identifies the smartest upgrades, and supports you through planning and implementation—every step of the way.

Using this process, your home can qualify for a Green Mortgage faster, enabling you to access significantly lower interest rates. The result? Tens of thousands of euro saved over the term of your homeloan.

Here's a current real-world example: -

*interest rates quoted as at 20 June 2025 from one of Ireland's largest mortgage lenders. Repayments calculated using CCPC mortgage repayment calculator.

Kevin and Aoife bought their house almost four years ago. It is a four-bedroomed semi-detached house in suburban Dublin, built in 1993, with a C3 energy rating.

Their mortgage balance is €375,000 with 27 years remaining on their mortgage. When they drew down their mortgage, the 'new business' 4-year fixed rate available was just 2.2%.

As they are exiting this 4-year period, their bank is now offering: -

-a variable rate of 3.95%,

- or a fixed 5-year rate of 4.3%.

-a 5-year green rate of 3.3%, for which the house doesn't YET qualify due to its C3 BER rating.

Kevin and Aoife have two children and use 6000 units (kWh) of electricity and 18,000 units (kWh) which are both approximately 25% above the national household average.

What are their options?

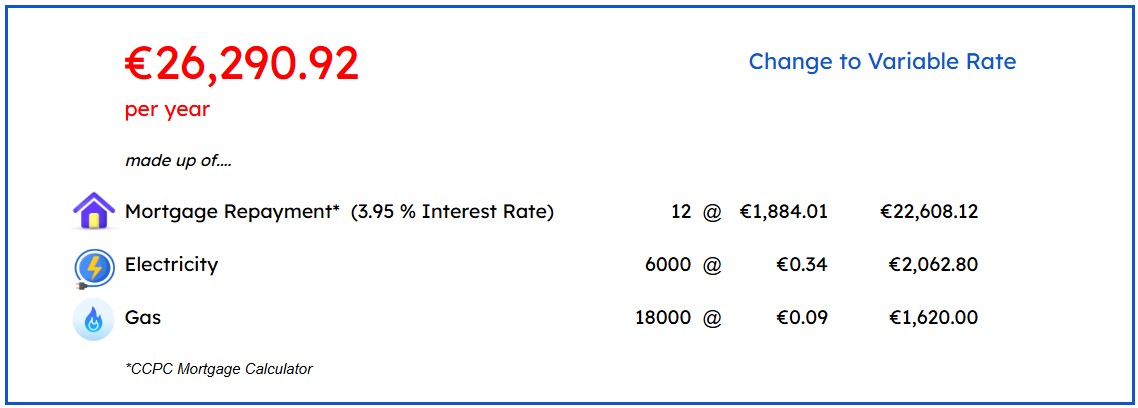

As they end their 4-year fixed mortgage at 2.20% , let's look at their currect combined mortgage and energy spend for 12 months.

As their current fixed-rate mortgage term is coming to an end, the available options seem to involve a significant increase in monthly outlay. While interest rates have fallen in during 2025, global political and economic uncertainty makes a fixed rate option seem like the most pragmatic option so that they can budget with some certainty. Howver, It looks like our homeowners are in for a significant hike in repayments: -

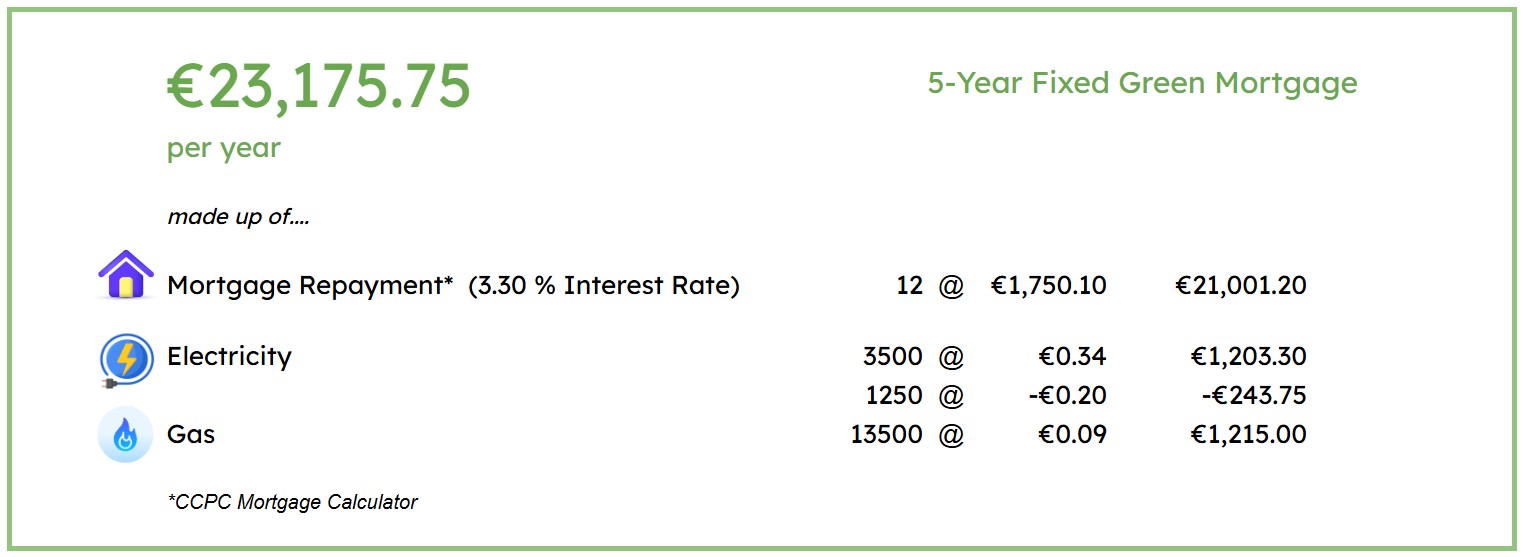

The most attractive option would be a fixed-rate Green Mortgage, which the house will qualify for with less than €10,000 of grant-funded energy upgrades, which will also deliver substantial energy savings.

In this case, combining a Green Mortgage with a few simple energy upgrades can provide real peace of mind—a fixed rate for 5 years and an impressive combined annual saving of

€4006.89

If you could switch to a Green Mortgage, just imagine what you could do with that extra money....

A dream holiday? Home improvements? Extra savings or investments? With lower repayments and a more energy-efficient home, the possibilities are wide open.